Accounting Services

Let us be an extension of your team

Many growing businesses struggle to create a well-tuned accounting process, especially as certain systems and processes need to change to support increased activity. While invoicing, accounts payable, and payroll often suffer first, improper or delayed accounting also stifles future growth by limiting the necessary data for strategic decisions. Business owners typically try to manage it themselves while balancing their many other duties or hire accounting staff to remedy the problem. However, this ties up additional resources, but it can be ineffective without the proper expertise and day-to-day guidance.

To help business owners overcome these challenges, Smith Schafer offers scalable accounting services. Whether you need help managing the daily routine or assistance with more strategic decisions, such as software analysis and selection, our accounting professionals can give you back valuable time and resources so you can focus on growing your company.

FREE GUIDE: WAYS OUTSOURCED ACCOUNTING CAN BENEFIT YOUR BUSINESS

Our Accounting Services:

- CFO Services

- Monthly Bookkeeping

- Monthly/Quarterly Bank Reconciliations

- Payroll Support

- Financial Reporting

- Accounts Payable Processing

- Forecasting and Budgeting

- Invoice Preparation

- Account Receivable

- Accounting System Design and Set Up

- Payroll Tax Return Preparation

- Quickbooks Pro Advisor Consulting

We know your industry:

Accounting resources

10 FAQs: Accounting for PPP Loans and Forgiveness

Under the Paycheck Protection Program (PPP), the federal government authorizes up to $349 billion in forgivable loans to small businesses during the COVID-19 crisis. Small businesses are receiving loans, and many have questions on how to account for the funds, expenses, and forgiveness in their accounting records.

Payroll Tax Credits & PPP Loan Guidance

In the last three weeks, two major pieces of stimulus legislation have been signed into law. Both acts provide opportunities for small businesses, but also require additional tracking for proper reporting.

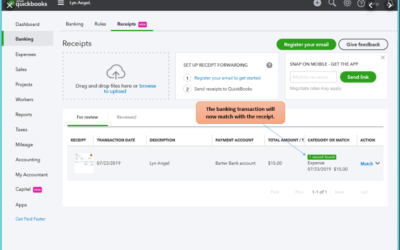

Do you use QuickBooks for your business?

QuickBooks is a accounting software program businesses use to manage expenses, sales and daily transactions. It can be used to invoice customers, pay bills, generate reports for planning, tax filing and much more.